You've probably heard of the term T20, M40 and B40 being used now and again, especially in official government announcements and news reports.

However, many of us may still not be clear what they mean.

These terms basically describe income classification in Malaysia. All Malaysians are categorized into three different income groups: the Top 20% (T20), Middle 40% (M40), and Bottom 40% (B40).

This is based on the Department of Statistics' (DOSM) Household Income and Basic Amenities (HIS/BA) survey of 2022 (conducted twice every five years).

Is it important to know what these classifications are as they will influence many aspects of your personal finances. For instance, when the government announces any tax reliefs, financial aid, health plans or additional taxations for your income group.

The T20, M40, B40 classification system is also used by private organizations and companies for marketing and promotional activities. For example, there may be special discounts for the B40 group when they make purchases.

The exact income values that determine the different classifications will change over the years. Let us examine what this means.

The Average Income in Malaysia

Results show that the average household income in Malaysia has increased to RM8,479 per month, from RM7,901 per month in 2019. This is an increase of 2.4%.

The median household income also increased to RM6,338 per month in 2022, from RM5,878 per month in 2019. This is an increase of 7.2%. Over the years, the bar for each group’s income level has increased and this is one of the indicators of economic growth.

Related: Our Comprehensive Personal Income Tax E-filling Guide

Important Concepts and Terms

Before we examine the income range of T20, M40 and B40, there are a few terms and definitions that are related to the classification issue. These terms will help you understand how the government defines and views the various financial capabilities of Malaysians.

- HOUSEHOLD: A person or a group of people (related or unrelated) who usually live together in living quarters and make provisions (expenses) for food and other necessities of life together. In 2022, the average size of Malaysian households was 3.8 persons.

- INCOME RECIPIENT: The average number of income recipients in a Malaysian household in 2022 was 1.83. This is a slight increase from the average of 1.8 in 2019. The increase in the number of income recipients is likely due to the increasing number of women entering the workforce and the rising cost of living.

- HOUSEHOLD INCOME: Overall income that is earned by household members, whether in cash or kind and can be referred to as gross income. The average monthly household income in Malaysia decreased from RM7,901 in 2019 to RM6,338 in 2022. This is a decrease of 19.1%. The decrease in household income is likely due to a number of factors, including the COVID-19 pandemic, the rising cost of living, and the economic slowdown.

- MEDIAN HOUSEHOLD INCOME: is the "middle" income number within a range of household incomes, arranged from low to high. For example, in Taman Bintang, there are five household incomes of RM5,000, RM10,000, RM15,000, RM20,000, and RM25,000; the median household income will be RM15,000. The median is used because it represents a more accurate representation of the area than a mean number (the average).

- MEAN HOUSEHOLD INCOME: is the "average" income number where all household incomes are added up and divided by the number of households.

So how do we get classified into the B40, M40, and T20 income groups?

| Median Monthly Income By Household Group | ||

| Household Group | Median Income 2022 (RM) | Median Income 2019 (RM) |

| T20 | 15,867 | 15,021 |

| M40 | 7,694 | 7,093 |

| B40 | 3,440 | 3,166 |

Household median income for T20, M40, and B40 in 2022 and 2019

| Monthly Income Range By Household Group | ||

| Household Group | Income Range 2023 (RM) | Income Range 2019 (RM) |

| T20 | > 10,960 | > 10,971 |

| M40 | 6,339 - 10,959 | 4,851 - 10,970 |

| B40 | < 6,338 | < 4,850 |

Income range for T20, M40, dan B40 in 2022 dan 2019

Keep in mind that the income group definitions are not fixed. The names, B40, M40, and T20, represent percentages of the country's population according to the Bottom 40%, Middle 40%, and Top 20% respectively.

The values may increase or decrease year-to-year, depending on the country's GDP, which is why the median household income is used as the determinant instead.

For instance, you can see that the M20 income range changes from RM4,851- RM10,970 in 2019, to RM6,339 - RM10,959 in 2023. Even the B40 income has changed over that time, from those below RM4,850 to every household earning below RM6,338.

Though the income levels for each group have improved over the past three years, we should not ignore the escalating cost of living resulting from inflation and slower wage growth.

Only the T20 income group seems to have seen a slightly lowered range, from RM10,971 in 2019 to RM10,960 in 2023.

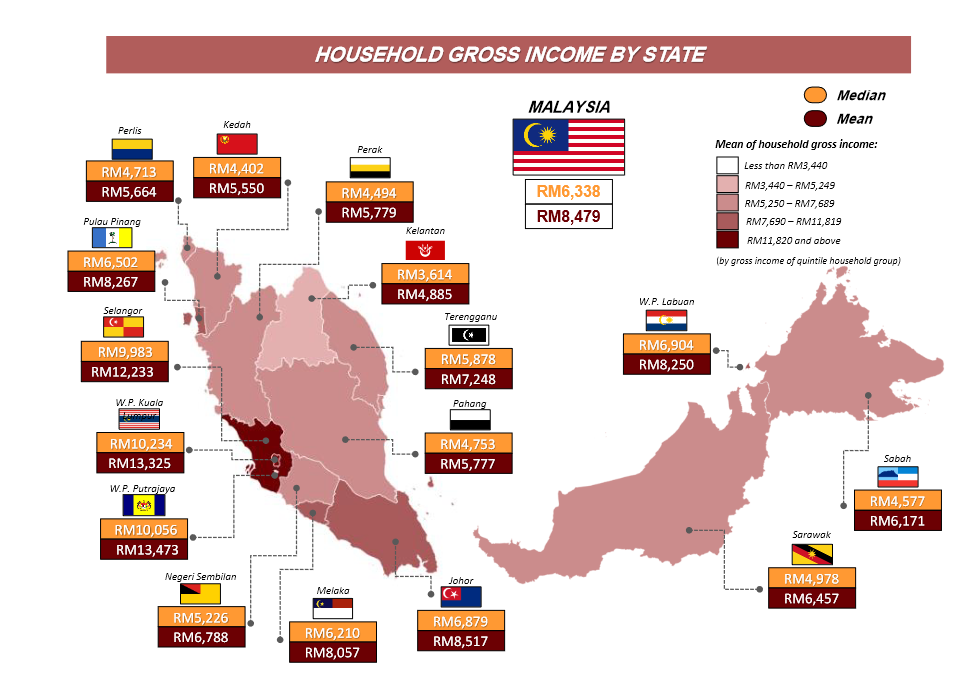

To explain this situation better, here’s the median and mean gross income level for each state and you can see if your household is above or below these mean and median levels.

Source: Household Income and Basic Amenities Survey Report 2022, Department of Statistics Malaysia

Based on the above data, we can conclude the following about certain states in Malaysia:

W.P Putrajaya

The Federal Territory of Putrajaya (W.P. Putrajaya) is the richest state in Malaysia because it is the seat of the federal government and home to many government agencies and departments. The high concentration of high-paying jobs in Putrajaya has led to one of the highest median income in Malaysia.

In addition, Putrajaya is a relatively small state with a population of only around 80,000 people. This means that the state's resources are not spread out as thinly as they are in larger states, such as Selangor and Kuala Lumpur. This also contributes to the high median income in Putrajaya.

Kuala Lumpur

Kuala Lumpur is the capital of Malaysia and is also one of the richest states in the country. The median income in Kuala Lumpur is RM10,056 in 2022. This is due to the city's status as a financial and commercial hub, as well as its high concentration of high-paying jobs.

Johor

Johor is one of the richest states in Malaysia due to its strategic location, strong economic growth, high human capital, and government policies. The state is located at the southern tip of Peninsular Malaysia, making it a gateway to Singapore and other parts of Southeast Asia. This strategic location has made Johor a popular destination for businesses and investors.

Kelantan

Kelantan is one of the poorest states in Malaysia, with a median income of RM3,614 in 2022. This is due to the state's relatively low level of economic development. Kelantan also has a lower educational attainment rate than other states in Malaysia.

Kedah

Kedah is another relatively poor state in Malaysia, with a median income of RM4,402 in 2022. It relies heavily on agriculture, has a high unemployment rate, and a low human capital.

The agricultural sector is a low-paying sector and many farmers live below the poverty line. The high unemployment rate is due to the lack of job opportunities in the manufacturing and services sectors. The low human capital makes it difficult for the state to attract businesses and investments.

Now that you know about the median income in different states, you should find out if your financial position is better or worse than the average Malaysians here.

Final Thoughts

The different Malaysia income groups have vastly different needs. That is why planning your finances according to your income level in Malaysia is important.

The median income for households will continue to rise due to inflation, so you should take this into consideration when planning and saving for the future too.

Making financial decisions is not easy, so remember to check out our blog for the latest insights and make your life better. You can also subscribe to our mailing list for the latest financial deals and insights.