Travel enthusiasts know that credit cards can make a world of difference when it comes to saving on flights, hotels, and other travel expenses.

If you want to apply for credit cards online, you'll see that that the choices for travel cards are more diverse than ever. From reward points to travel insurance, each card offers you different perks to suit your needs.

To help you select the ideal card for your travel needs, we've reviewed and compared some of the best travel credit card available

Let's look at the details of each travel credit card and how they can be your perfect travel companion.

😍HSBC TravelOne Credit Card

Here's a card that doesn't just reward you, it helps keep you safe when you travel. It offers an instant cash advance option. You'll be able to cash out with any ATM worldwide within 24 hours in cases of emergencies where credit cards are not accepted. Additionally, the card comes with a generous complimentary travel insurance coverage, up to $250,000.

Avid traveler will love the instant redemption option, available for a wide range of airlines and hotels via the HSBC Malaysia Mobile Banking app.

Apart from being able to claim reward points from hotels and airlines, you can gain points from overseas spending too.

Main benefits:

- Reward points for a wide range of local and international travel and dining including up to 8X points for overseas spend and 5X points for local travel and dining spend.

- Complimentary travel insurance coverage of up to USD250,000 in travel insurance coverage (including travel medical, travel inconvenience – flight and baggage delay, baggage loss, COVID coverage, etc).

- 6X Complimentary access to participating Plaza Premium Lounges worldwide per year.

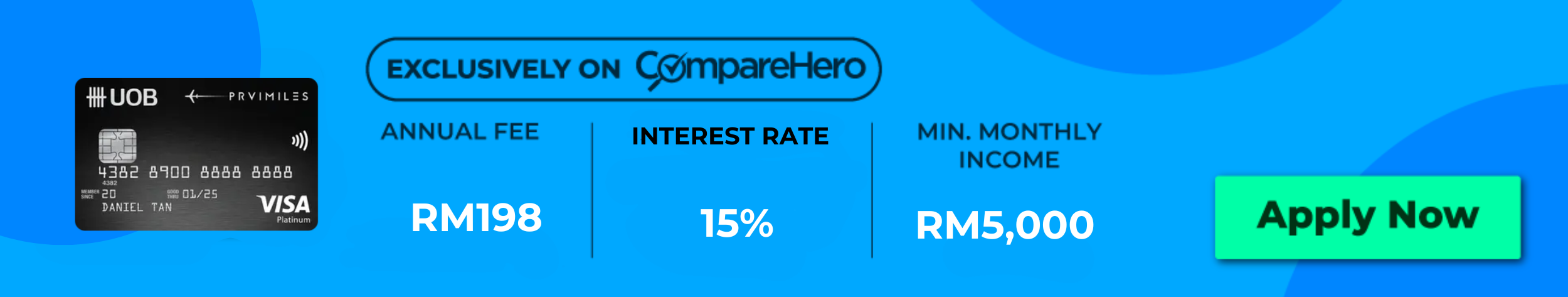

🌴UOB PRVI Miles

The UOB PRVI Miles Credit Card is the perfect card for those who love collecting points. The card rewards you with UNIRinggits (UNIRM) for your spending.

This includes instances when you need to make travel agency bookings, which aren't found with many other cards.

The 50% discount on Grab rides offered by this card is bound to come in handy for airport transfers and for domestic trips too.

Main benefits:

- Earn 5X UNIRM reward points on overseas, hotel, airline and travel agency spend to redeem as you please

- Get a 2,000 UNIRM bonus when you make a retail spend at least 3X per month (minimum spend applies and with limited redemptions).

- 50% OFF on Grab Rides (up to RM10 off and with limited vouchers).

🚢Standard Chartered Journey Credit Card

Here's the card for those that want to travel in style. With the Standard Chartered Journey card, you'll be able to fully enjoy unlimited access to the comforts and amenities of the Plaza Premium Airport Lounge at both KLIA 1 and 2. Waiting for you flights will now be a luxury experience rather than a chore.

Additionally, you can also save on travel expenses when you redeem Miles points, which rewards you for overseas spend too. Your savings will be further enhanced with complimentary Grab airport transfer and waiver of the first year annual fees.

Main benefits:

- Redeem 1 Mile for every RM 1 spent on dining, travel and overseas purchases. Travel spend includes airlines, hotels and online travel agencies.

- Get 1 Mile for every RM5 local spend.

- Unlimited access to KLIA, KLIA2 airport lounges.

- Complimentary airport transfers via Grab.

- Travel insurance coverage of up to USD100,000.

- Complimentary E-Commerce Purchase Protection when you shop online with up to USD200 coverage.

✈️Alliance Bank Visa Infinite Credit Card

Here's a card that you can count on when you're in a pinch overseas. The Alliance Bank Visa Infinite doesn't just reward you for overseas spend, it provides you 24/7 support which will come in handy if you ever face any payment issues while travelling.

Apart from that, you can enjoy flexible payment plans with 0% interest rates when you spend on flight tickets, hotel bookings and overseas purchases. This is bound to give you more room in managing your finances when planning a trip.

Main Benefits:

- 8X TIMELESS BONUS POINTS on e-commerce and eWallet top-ups, which will never expire.

- 5X Timeless Bonus Points on overseas, groceries and dining spend.

- 0% Flexi Payment Plan for Flight Tickets, Hotel & Overseas spend.

- 2X Complimentary access to participating Plaza Premium Lounges worldwide.

- 24/7 personalized assistance in dining, travel and entertainment at home or abroad!

🚋Hong Leong Sutera Platinum

The Hong Leong Sutera platinum is the best travel credit card in Malaysia for young adults and solo budget travelers. With its minimum income limit at RM3,000 this highly accessible card allows you access to various travel perks.

Chief of these benefits is 8X reward points for online, overseas, groceries and dining spend. These reward points can then be used to redeem hotel and dining vouchers, as well as frequent flier miles.

Hong Leong also covers you with up to RM1.7 million in terms of travel insurance if you're a card holder.

🌏CIMB Travel Platinum

This accessible card from CIMB comes with perks for everyday use, and not just for travel. Although it is a travel-centric card, you'll be able to own it with just a minimum monthly income of RM2,000. On top of that, it has ZERO annual fees, which is waived for life.

Enjoy 5X Bonus Points for every RM1 spent on airlines and overseas transactions. Additionally, you'll get up to RM1 million travel insurance coverage and 4X complimentary access to Plaza Premium Lounge annually.

😁Maybank Visa Infinite

For the luxury business traveller, there's the Maybank Visa Infinite, which is designed for those who need to travel frequently for work. Among the attractive features include access to both international and local golf clubs, and a Visa Airport Speed Pass at over 280 international airports, where you'll be fast-tracked at immigration.

There's also 5X complimentary access to Plaza Premium Lounge, and various promotions and discounts at fine dining establishments. Earn up to 5X TreatsPoints on overseas spend and an annual fee waiver on the first year of use.

In subsequent years, you'll enjoy free annual fees when you spend at least RM80,000 per year on the card.

The Bottom Line

As a frequent traveler, a travel-friendly credit card will give you plenty of perks and advantages. However, it's the savings you get when you redeem airmiles points that will truly make your trip worthwhile.

At CompareHero, you'll see all our travel-centric credit cards on one platform. This lets you weigh your options and make more informed decisions as to which cards truly suit your travel style.

If you're still unsure, find out more by contacting us and we'll help you along with any questions you may have.