Zakat is an obligation that must be fulfilled by all eligible Muslims. It must be paid annually by every Muslim whose total annual wealth meets nisab threshold or the minimum amount for a Muslim net worth to be obligated to give Zakat. If this is your first time paying Zakat, here’s a simple guide for you to refer to:

What is Zakat?

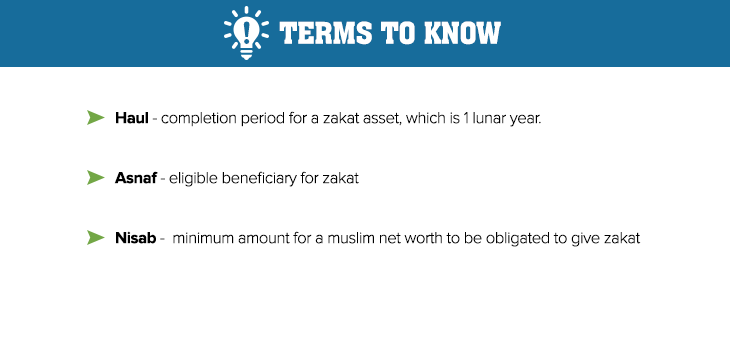

Zakat is the third pillar of Islam and is wajib (compulsory) on Muslims who meet all the conditions. The word Zakat itself means to purify. Technically, Zakat means a fixed proportion collected from a specific type of mal (wealth) when they reach the haul (specific term) which must be distributed to specific categories of people.

A common misconception is that Zakat is a form of the Islamic tax system, which it is not. Zakat is an assigned amount that is worth 2.5% of your wealth which is to be paid to the community. The community are then to use the Zakat contributions to support the less privileged among them.

What’s the purpose of Zakat?

Giving Zakat means Muslims are purifying their wealth by giving a part of it to the needy as well as to gain Allah’s blessing on their wealth. It teaches us to sacrifice a part of our wealth, to cleanse our wealth by means of Zakat.

As Muslim, we also believe that everything belongs to Allah as stated in the Quran, “To Him belongs all that is in the heavens and on earth” (2:255). When we are given wealth, there is a portion that does not belong to us which is also stated in the Quran “And in their wealth, there was a right for one who asks and for one who is deprived” (51:19)

When should you pay Zakat?

Zakat can be paid any time of the year, however, most Muslims prefer to perform this obligation during the month of Ramadan as rewards for performing good deeds are multiplied.

As for Zakat Fitrah, the payment can be made throughout the month of Ramadan. However, it becomes compulsory between sunset on the last day of Ramadan until sunrise on the first day of Syawal. from 1 Ramadan 2021 onwards until the morning before Hari Raya Aidilfitri prayer.

It is compulsory for the head of the household to pay the zakat fitrah during the time between sunset on the last day of Ramadan and sunrise of the first day of Syawal. However, this payment can also be made throughout the month of Ramadan.

The best time is for the payment to be made before the Eid prayers on the first day of Syawal.

The best way to know when you should pay Zakat is when your total wealth meets the nisab requirement. It’s also important to note that your Zakat is due exactly one year after, given that your wealth still meets or exceeds the minimum nisab requirement.

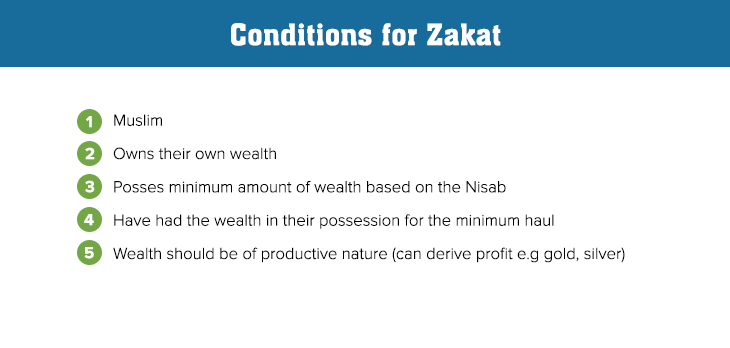

Who is eligible to pay Zakat?

Zakat is wajib or compulsory for all adult Muslims, whose total annual wealth meets or exceeds the nisab. Below are the conditions every Muslim must meet:

Who is eligible to receive Zakat?

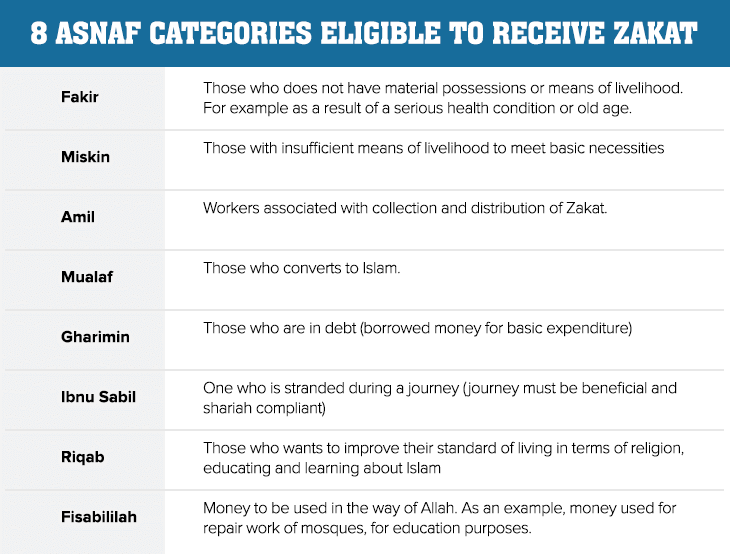

Here are the eight asnaf categories who are eligible to receive Zakat:

What are the types of Zakat?

The types of Zakat are on livestock, crops, and earnings from business, income, savings, gold and silver. There are also the lesser-known types of Zakat which are Zakat on KWSP withdrawals and Qadha Zakat.

There are two types of Zakat that Muslims are obligated to pay in Malaysia:

1. Zakat Al-Mal (Zakat on wealth or Zakat Harta)

Muslims are required to pay Zakat Harta every year once they have reached a certain financial requirement. The types of wealth included under Zakat Harta are:

- Zakat on earnings

- Zakat on business

- Zakat on savings

- Zakat on gold and silver

- Zakat on EPF

- Zakat on farming

- Zakat on livestock

Muslims who are employed for more than a year and earn the minimum income must perform their Zakat on earnings. The nisab, or the minimum amount, is equivalent to 85g of gold - the amount differs by state. For example, the nisab for Zakat Harta in Selangor for the current year 2021 is RM20,920.

Muslims who meet the nisab requirements are obligated to contribute 2.5% of their income as Zakat. The income includes all types of wages and payments obtained from their work such as salaries, royalties, commissions, rental income, bonuses and freelance payments.

2. Zakat Fitrah (Zakat on the individual)

Zakat Fitrah must be paid by all Muslims every year, regardless of age, gender or wealth. This type of Zakat is performed in the month of Ramadan as Muslims are obligated to pay it before Eid prayers.

The rate for Zakat Fitrah is equivalent to the cost of a meal or a bushel of rice weighing 2.7kg. Each state announces the Zakat Fitrah rate for the year based on the local rice’s current price, and the amount of Zakat Fitrah per person usually does not exceed RM10.

Zakat Fitrah rates in Malaysia 2021

Below are the current Zakat rates in Malaysia for each state:

| State | Rate | Pay online |

| Perlis | RM7 | Click here to pay |

| Pulau Pinang | RM7, RM12, RM16 | Click here to pay |

| Kedah | RM7, RM14, RM16 | Click here to pay |

| Perak | RM7, RM14, RM21 | Click here to pay |

| Selangor | RM7, RM14, RM21 | Click here to pay |

| Wilayah Persekutuan(KL, Putrajaya & Labuan) | RM5, RM7, RM14 | Click here to pay |

| Melaka | RM7, RM14 | Click here to pay |

| Johor | RM7, RM10 | Click here to pay |

| Pahang | RM7 | Click here to pay |

| Terengganu | RM7 | Click here to pay |

| Kelantan | RM7, RM14, RM21 | Click here to pay |

| Sarawak | RM7 | Click here to pay |

| Sabah | RM7 | Click here to pay |

| Negeri Sembilan | RM7 | Click here to pay |

Where does your Zakat contribution money go to?

Lembaga Zakat Selangor (LZS) focuses on the muqadam (primary) beneficiaries which are the fakir, miskin and mualaf asnaf. The Zakat money collected goes into various efforts and aid we provide for them. Among the efforts and aid are for basic living expenses, education fees, and medical bills.

A large amount of Zakat money collected by LZS goes towards facilitating medical bills for the poor. Specifically the cost of dialysis. The cost to accommodate those on dialysis is about RM2,000 to RM5,000 per person every month.

Zakat contribution also goes towards walking in cases they receive daily at our express counters for emergency cases where cash will be provided for those in need.

Can Muslims give Zakat directly to the poor?

Giving zakat directly to the poor is like the obligatory prayers carried out individually, which means it is sah (valid) but with less reward. When you give Zakat money to Zakat institutions it is like carrying out the obligatory prayer in a jemaah (congregation), it is sah and you get extra rewards for it because the Zakat institutions are better equipped to ensure the money is utilised correctly and effectively.

However, it is not encouraged because people may not be fully aware if the beneficiaries whom they give the Zakat money to are eligible to receive Zakat. Before a person can be classified as asnaf there are checks involved. Unlike Zakat institutions, an individual would likely not have the ability to carry out necessary checks. If the individuals are not eligible, the contribution will not be considered as Zakat even if you make the niyat (intention) of paying Zakat and the obligation of Zakat would not have been fulfilled.

Another concern is how the money is spent. When people give Zakat directly, it is usually one-off contribution, once a year. What would happen to the needy for the remaining months? Zakat money that is given to Zakat institutions are managed to ensure the needy receive aid throughout the year, not just once a year. Zakat institutions like LZS also go beyond just giving the asnaf money. We work towards helping them get out of poverty and we work closely with children from poor families to develop and ensure they get access to higher education.

You see bigger impacts when Zakat money is handed to Zakat institutions compared to giving it directly to the needy. It is important for people to know that Zakat institutions are equipped to handle Zakat contributions to ensure the distribution goes to the right individuals, which is why Muslims are encouraged to contribute to the Zakat institutions.

How does LZS ensure there are no mishandlings of the Zakat money collected?

From operation costs to the breakdown of Zakat distribution, all of the information is available publicly. Every cent is audited and LZS is transparent about it all. Audits are carried out through the internal audit by Majlis Agama Islam Selangor (MAIS), a quality audit by SIRIM, the national audit as well as state audit.

They publish the data through the website and they also use social media as a platform to inform people of how we distribute the Zakat collection. Their yearly reports, along with the distribution figures are available online and for the public to see so there should not be an issue of lack of transparency.

Note: All of the yearly reports on LZS’s Zakat collection and detail of its distribution can be accessed here.

How to pay for Zakat?

There are several ways on how you can pay Zakat:

- eZakat Pay

- Internet banking

- Lembaga Zakat Selangor branch

- Post office

- At the bank counter

- Credit card

- Monthly salary deduction scheme

- SMS

- Phone banking

- ATM machine

- Official agents

Be sure to check your respective state’s official zakat website for the right payment methods.

How is Zakat Harta calculated?

If you’d like to know how to calculate your Zakat, below are examples and the formula. Additionally, you can also use LZS’s online Zakat calculator.

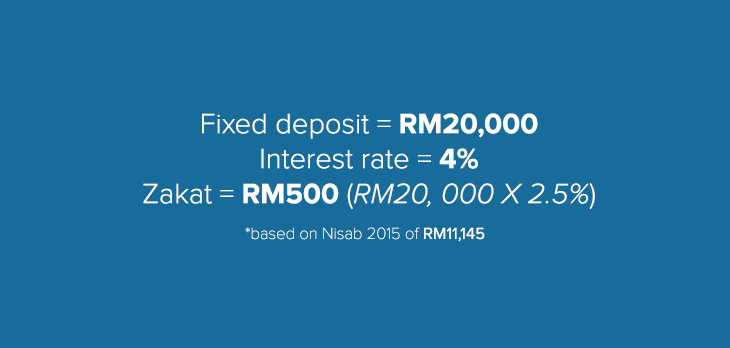

Calculation example for Zakat on savings

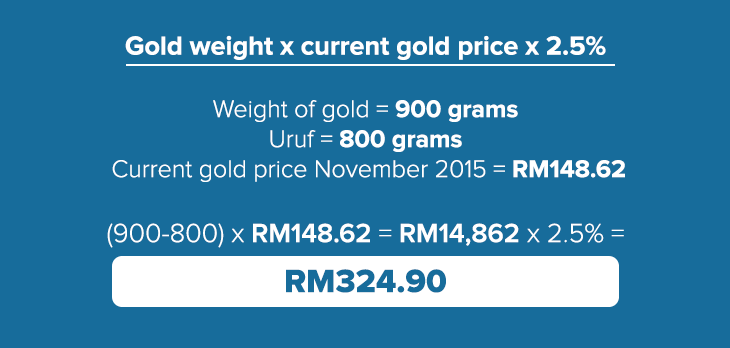

Calculation example for Zakat on gold

*Uruf is the normative amount or the customary limit. When a person has gold amounting more than the uruf they are required to make Zakat contribution for it.

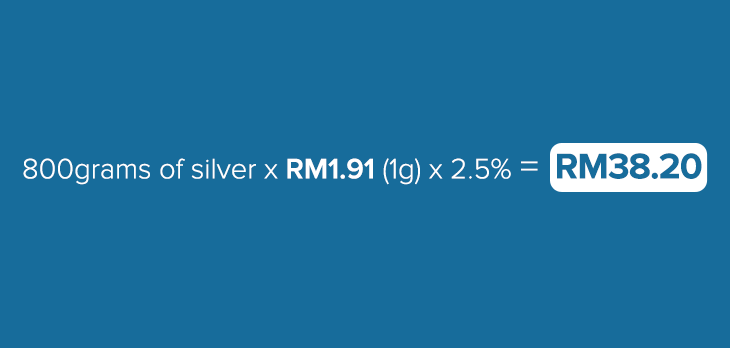

Calculation example for Zakat on silver

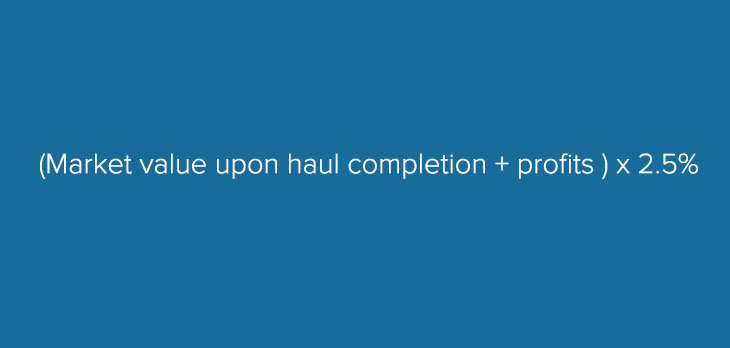

Formula for Zakat on stock

Looking for a hassle free way to pay your Zakat? Why don't you use an Islamic credit card. Compare the best Islamic credit cards on CompareHero.my for free here.

Related: The Basic of Islamic Banking

Zakat income tax rebate in Malaysia

Tax rebates are also given to Muslims that pay Zakat. The rebate amount will be based on how much you paid during the tax year. It is referred to as the had kifayah (minimum needs for an individual or family), the amount differs from state to state as it is determined by each state’s Islamic religious council. Your Zakat payment can reduce the actual amount of income tax you have to pay.

Remember that the purpose of Zakat is to maintain economic balance in society so that the circulation of wealth continues from rich to poor in a proper channel. It’s also a way we can learn how to be grateful for what we have, and the importance of fulfilling our obligations as Muslim.

.png?width=280&name=FI_Lazy_Person_s_Guide_to_Achieving_Financial_Freedom_with_Minimal_Effort-01%20(1).png)