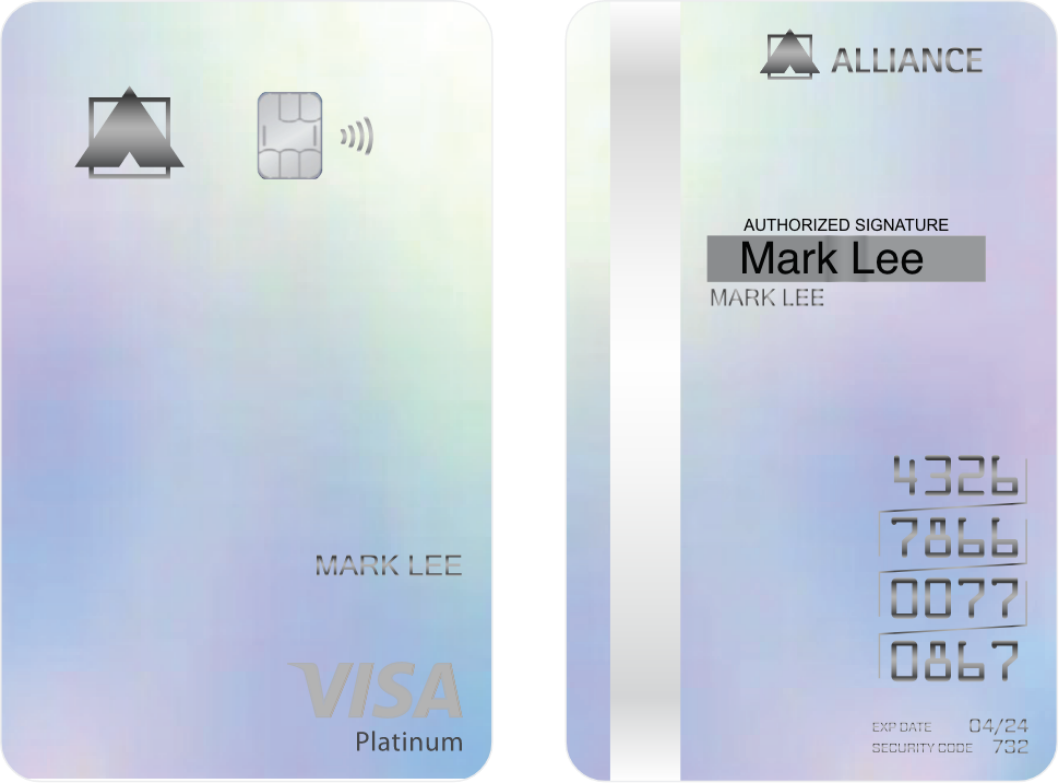

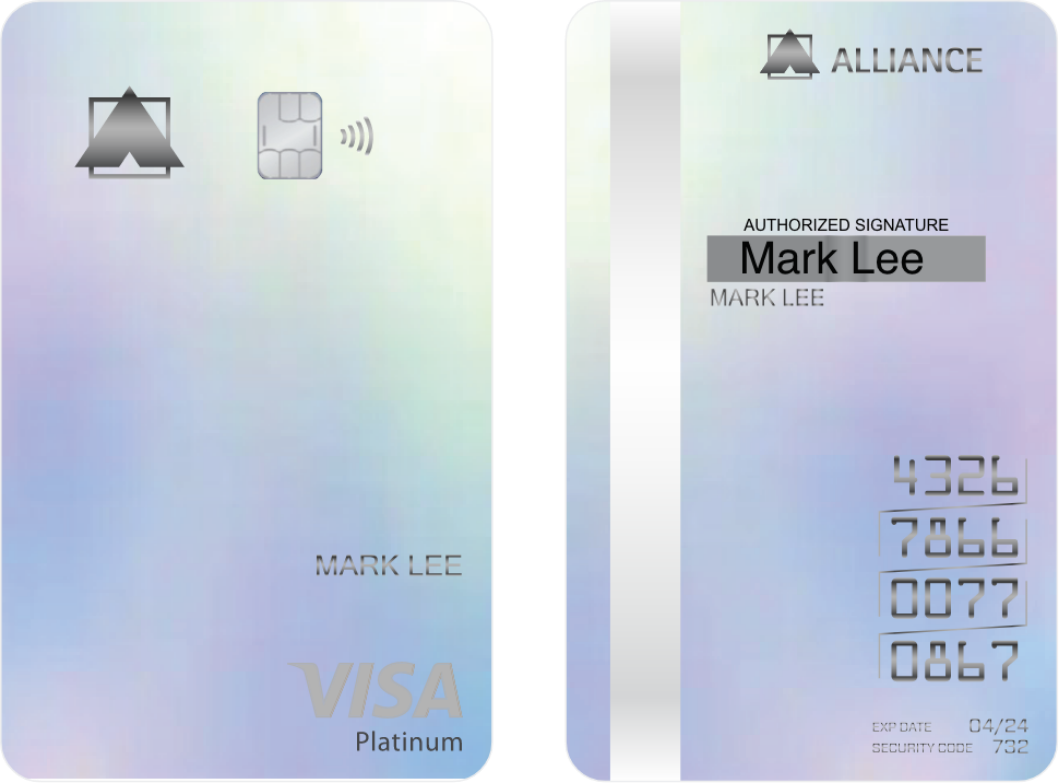

Alliance Bank Visa Platinum Credit Card

| Minimum monthly income | RM 2,000 |

| Minimum age: | |

| Cardholder | 21 |

| Supplementary Cardholder | 18 |

| Annual fee | RM 0 | Free* |

| Annual fee waiver | Yes | Free for the first year, and waived with minimum 12x swipes per year (no minimum spend) in the subsequent years. Otherwise, RM120 for Principal Card and complimentary for Supplementary Card |

| Late payment fee | RM 10/1% | 1% of the outstanding balance or RM10, whichever is higher (to a maximum of RM100) |

| Interest rate | 15% | Settling minimum payment due for 12 consecutive month |

| Balance transfer rate (fixed) | 0% | 0% Balance Transfer for 6 months with minimum transfer of RM1,000 (for new-to-bank customers only) |

| Annual fee |

RM 0 Free* |

| Annual fee waiver |

Yes Free for the first year, and waived with minimum 12x swipes per year (no minimum spend) in the subsequent years. Otherwise, RM120 for Principal Card and complimentary for Supplementary Card |

| Late payment fee |

RM 10/1% 1% of the outstanding balance or RM10, whichever is higher (to a maximum of RM100) |

| Interest rate |

15% Settling minimum payment due for 12 consecutive month |

| Balance transfer rate (fixed) |

0% 0% Balance Transfer for 6 months with minimum transfer of RM1,000 (for new-to-bank customers only) |

You will need to provide several documents such as (varies between different banks):

Salaried Earners

MNC/PLC/GLC

Salaried Earners

Non-MNC/PLC/GLC

Self Employed

Love receiving rewards and enjoying travelling? The Alliance Bank Visa Platinum Credit Card helps to fulfil both the things you love!

This credit card offers more Timeless Bonus Points than the Gold Visa. Here’s a rough breakdown of the Timeless Bonus Points you’ll be receiving:

| Category | Timeless Bonus Points Earned |

| E-commerce transactions and e-wallet reloads | 8 Points (For each RM1 spent) |

| Overseas and dining transactions | 3 Points (For each RM1 spent) |

| Contactless transactions, auto-billing, entertainment and other retail transactions | 1 Point (For each RM1 spent) |

The best part of it all, the Timeless Bonus Points collected will not expire, hence, you can redeem exclusive products, gifts and more from participating merchants such as Philips and Fitbit. That’s not all you can redeem with your Timeless Bonus Points!

If you’re a supplementary cardholder of the Alliance Bank Visa Platinum Credit Card, you’re not required to pay an annual fee, hence, this privilege does not apply. However, primary cardholders are charged RM120 every year. Though during the first year, it will be waived, after that, you will automatically be charged with the said annual fee.

You will also receive a chance to get your annual fees waived if you swipe your card at least 12 times. Luckily, there is no minimum spend too, so you can swipe at any amount, as long as it is 12 times and above.

With a low minimum requirement of only RM2,000, you can apply for the Alliance Bank Visa Platinum card. If you are 21 years old and above, you can apply for the primary card. Otherwise, you can apply for the supplementary card if you are 18 years old and above.

If you apply for the supplementary card, you will not be charged with any annual fee. As for the primary/ principal card, you need to pay a fee of RM120 every year. The first year, you are off the hook. But in the years after that, you need to pay the RM120 unless you have met the requirements of getting your annual fee waived, which is just making 12 swipes (no minimum spend) throughout the year.

Besides the annual fees, there are late payment fees and cash withdrawal fees. The late payment fee is around RM10 or 1% and the cash withdrawal fee is RM15 or 5% of the total amount. You will also be charged with sales and service tax that applies to both supplementary and primary cardholders, which is RM25.

For those who love to get rewarded and travel at the same time. Besides that, if you often shop online and use e-wallets, you’ll hugely benefit by getting the rewards in which you can redeem cool products.